Hillsdale College students should graduate with more debt than most colleges because Hillsdale is a private institution and therefore more expensive, according to national statistics and dozens of federal reports. But Hillsdale defies the trend.

Hillsdale College students should graduate with more debt than most colleges because Hillsdale is a private institution and therefore more expensive, according to national statistics and dozens of federal reports. But Hillsdale defies the trend.

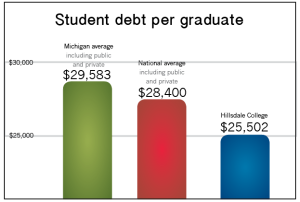

The Student Debt Project by The Institude for College Access and Success released its ninth annual report Nov. 13, announcing that now in six states, the average college student graduates with more than $30,000 in student loan debt. According to the data, only one state — New Mexico — averages less than $20,000 in student loan debt per graduate, with the national average of student debt per graduate at $28,400. According to a 2013 Student Loan Affordability report by the Consumer Financial Protection Bureau, “there are more than 38 million student loan borrowers with over $1.1 trillion in debt.”

Michigan is the state with the eighth-highest average amount of student debt, reporting $29,583 per graduate. This includes public and private institutions.

While Hillsdale ranks about $4,000 lower than the state average, among private institutions alone it ranks even lower. Calvin College and Hope College claim an average debt of $34,978 and $30,289 respectively, according to the report.

Because private colleges’ costs of attendance are higher than the costs of public institutions, students who graduate from private institutions — like Hillsdale College — are more likely to have more debt and encounter more difficulty in paying off their debt, negotiating payment plans, and applying for home mortgages.

Director of Financial Aid Rich Moeggenberg said the average amount of debt per student in the 2014 graduating class was $25,502, which is lower than the average student debt per student of most private institutions.

“Our purpose is to make a Hillsdale education affordable. It is part of the recruiting process,” Moeggenberg said. “We’re unique. We’re one of three schools in the country who doesn’t accept federal aid. If you look at tuition costs compared to other private colleges, we’re very competitive.”

Hillsdale graduate Will Wegert `12 majored in marketing and now runs his own business, Cold Collar, which assists job seekers with resume building and job hunting. Wegert said he believes students should choose to take out loans only if they truly believe in the education they are to receive.

“Few people consider how much it’s going to cost them and what the benefit of that is,” Wegert said. “My biggest concern is that people never seem to think about the value in it, they just do it because everyone else is doing it. In our parents’ generation, if you got a college degree, you could move forward. In our generation, it can help, but it also [might] not help it at all.”

According to Wegert, students need to evaluate why they want an education. If students aren’t responsible about their money and their education, then they will regret these decisions later in life when they have thousands of dollars in student loans.

“If you fought through all that, and it’s still worth it, then do it, but don’t do it because your parents and teachers told you that’s what you need to do to be successful,” Wegert said.

Moeggenberg added that “[taking out loans] is part of affording school. It’s an investment a Hillsdale education is going to pay off in a lot of ways.”

Paying for all four years is difficult for many students and may encourage them to take out more and more loans. But Moeggenberg believes students should not be taking out large loans to pay for school, even for a Hillsdale education.

“There’s a lot of counseling that happens for students taking out loans. We don’t want students taking out $50,000-$60,000 loans,” Moeggenberg said.

Students who prove they are invested in their education and want to better the Hillsdale community can find themselves eligible for all kinds of scholarships, Moeggenberg said.

“Dr. Arnn likes to say we like to have students to help run the place,” Moeggenberg said. “We try to reduce loan debt by looking for scholarship opportunities. If you look at other schools, we do very well in that arena.”

While Hillsdale’s cost of attendance and average debt per student is much lower than the state and national averages, the costs are still high and students can find it challenging to make a liberal arts education affordable. But when students believe in the work they are doing at Hillsdale and act responsibly, their education may be well worth it.

“We have students who are serious about getting a degree, and the fruits of that will show in the workforce,” Moeggenberg said.